An Unbiased View of Mortgage Rates Today

Wiki Article

The 10-Minute Rule for Mortgage

Table of ContentsThe Single Strategy To Use For MortgagePayday Loans Things To Know Before You Get ThisThe Best Strategy To Use For Loans For Bad CreditThings about FedloanLittle Known Facts About Mortgage Rates Today.

Social work We believe in repaying to our communities by sustaining regional organizations and also donating our time as well as talents. We even offer partners a paid time off annually to volunteer with a root cause of their choice.The quantity of this tax obligation, which is a little more than. 0035 times your funding quantity (or simply over $35 for a $10,000 finance), will be included in your funding quantity if your finance request is approved and also funded. Stamp tax is NOT consisted of when determining financing rate of interest. The tax obligation amount is not included in the priced estimate APR.

At least 25% of approved applicants applying for the most affordable rate certified for the lowest price available based on data from 10/01/2021 to 12/31/2021. Automobile, Pay discount is only readily available prior to financing funding.

Not known Incorrect Statements About Fedloan

Optimum APR for a Light, Stream financing is. 1 You can money your funding today if today is a banking business day, your application is accepted, as well as you complete the adhering to steps by 2:30 p.We are pleased to introduce that we have become part of a contract to acquire Individuals's United Financial, Inc. "In People's United, we have actually discovered a partner with an equally lengthy history of offering as well as sustaining consumers, companies and also neighborhoods," said Ren Jones, chairman and also president of M&T Financial institution Firm, that will lead the mixed business in the exact same ability.

A financing can help you pay for the things require when you don't have the cash money, but obtaining money can be made complex. Discover what to anticipate and also what you can do ahead of time to boost the chances of obtaining approved.

See This Report about Personal Loan

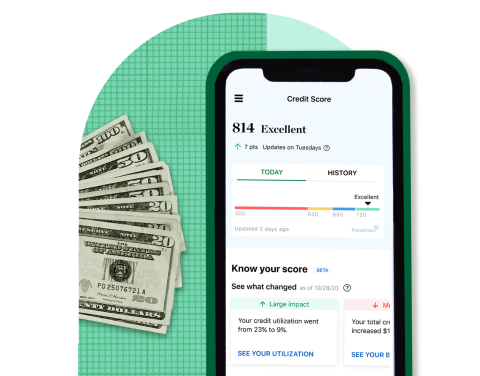

Once you develop a strong credit score background, lenders will certainly provide you moreand at lower interest prices. Review your credit scores history to see what lending institutions will certainly see when you ask for a lending.This means you might need to construct credit scores prior to you obtain a lending by slowly including loans to your history. Be certain to check my reference fix any type of mistakes in your credit scores files, as they make you a high-risk debtor in the eyes of lending institutions as well as hurt your possibilities of getting a good loan.

If you do not make car loan settlements on time, your credit report could go down. This is why it is essential to pick the appropriate borrowing amount. Think about the quantity you need based on what you intend to do with the cash. Additionally element in what your normal loan settlements could be and whether you can maintain up with them according to the car loan payment duration, be it month-to-month or quarterly.

That permits you to see exactly how much you'll pay for a car loan of a specific quantity, and how a different funding amount (or financing term, or rate of interest) could conserve you money. There are plenty of online devices out there to assist you calculate fundings. Obviously, lending prices and loan provider terms can make your final financing installations slightly different.

9 Easy Facts About Current Mortgage Rates Described

Understand the Finance Prior to you obtain a bank loan, take a look at just how the financing jobs. mortgage. Just how will you pay off itmonthly or simultaneously? What are the rate of interest expenses? Do you need to repay a certain way (perhaps the lending institution needs you to pay digitally with your checking account)? Ensure you comprehend what you're getting into as well as how everything will certainly work before you obtain cash.

Get a car loan read this article that you can really handleone that you can comfortably settle which won't prevent you from doing other vital points (like conserving for retired life or having a little fun). Identify just how much of your earnings will approach lending repaymentlenders call this a financial obligation interest only mortgage to earnings ratioas well as obtain much less cash if you do not like what you see.

All about Mortgage Rates

When filling in an application, you'll give information about yourself as well as your finances. You'll need to bring identification, supply an address as well as social security number (or equivalent), as well as supply info regarding your earnings - loans. Prior to you use, see to it you can give proof of a constant earnings to enhance your odds of being accepted for an individual lending.During underwriting, lenders will certainly pull your credit scores (or just use a debt rating) and also assess your application. They might call you periodically and also ask you to clear up or show something. Make sure to conform with these requests in a prompt way to avoid prolonging the funding application procedure. Service Loans Company financings resemble any type of other kind of bank finance.

However, new businesses don't have a lengthy borrowing background (or credit scores). New business and service organizations usually don't own assets that can be pledged as security, so they need to function a little harder to get loans. Lenders typically consider the consumer's personal credit scores and also revenue to identify whether they receive a business lending.

Local business owner who don't have adequate service credit history may likewise need to pledge personal assets as security to get car loans. This is typically the only method to get financings in the early years, but you ought to try to construct service debt so you can at some point borrow without running the risk of individual properties.

Report this wiki page